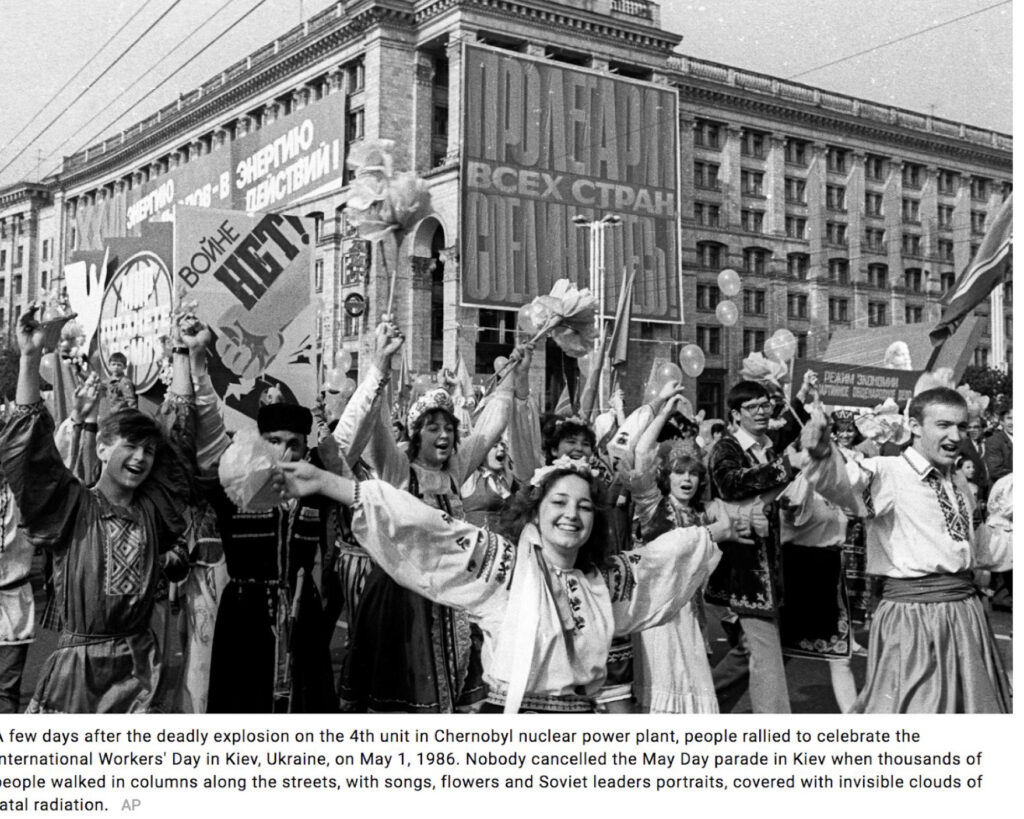

I was born in the Soviet Union and was six years old when the Chernobyl tragedy struck: in the early hours of April 26 in 1986 a sudden surge of power in the Chernobyl reactor led to its explosion.

Four days later, my family together with the whole Soviet Union rallied to celebrate the International Workers‘ Day. We were still in blissful ignorance at the time. Children were handed flags and balloons, an order by Komsomol, and told to shout at the top of their lungs to every slogan.

„Statewide Electrification not in five but in three years!“ – Hooray!

Mir, Trud, Mai! – Hooray!

Little did we know that the air above us was filled with deadly radioactive particles galore.

35 years later, this very image springs to my mind as I am contemplating the stock market’s rally: the stocks are celebrating the post-Covid bright future and the Fed prints the unlimited cash in a form of a sudden surge of power liquidity, and where the wallstreetbets retail-traders proclaim, that Bitcoin and stocks only go up, and instead of a „Statewide Electrification“ slogan we hear „Tesla cars for everyone not in five but in three years“.

Alternatively to Gosplan, we hear Cathie Wood forecasting Tesla to hit $3’000 in five years. (Al Jazeera)

Similarly to invisible clouds of fatal Chernobyl radiation, we’re experiencing invisible clouds of fatal inflation as the Fed continues with its printing experiment while the hopium is still working its charm.

„Hooray, comrades! Stocks only go up! Bitcoin to the Moon! Hooray!“

Everyone is talking about Bitcoin and NFTs (Non-fungible tokens) these days. Have you made your own NFT lately?

By all appearances, Bitcoin is undoubtedly the future asset. Progressively, more and more financial institutions are showing interest in Bitcoin as the ultimate hedge against inflation.

Promptly after Elon’s Tesla or Microstrategy, such giants as Mastercard, PayPal, Goldman Sachs, and Morgan Stanley are expressing enthusiasm for Bitcoin. However, in my humble view, Bitcoin urgently needs a long awaited correction for a further cycled advance.

The BTC/USD exchange rate is struggling to stay above $61’000 after a frighteningly spectacular bull run this year. In my opinion, the great exodus rotation from „stay-at-home“ stocks (tech, vaccine, zoomer stocks) into value growth stocks has only just started.

This time the technology stocks together with the crypto assets will be under significant pressure from the strengthening US dollar.

But not only tech stocks, the whole emerging market sector will be put under rates pressure. Take a look at Turkey’s selling gold-backed bonds or Russia’s curbing its out-of-control inflation.

I sincerely doubt whether the Fed would ever step in to save the emerging markets or even Bitcoin from a lurking Chernobyl-like crash. Keep in mind that Bitcoin boasts itself as a decentralized non-fiat asset.

The Federal Reserve has enough problems as it is these days. After jawboning the markets last week, Powell chose not to dampen the inflation fires.

Let’s check the continuous bloodbath in the investment grade bonds market heralding the worst year for bonds so far. But nobody is mentioning it.

To use the words of the Wallstreetbets participants: Only losers take profits as Nasdaq and Tesla are surging.

According to statistical data, the markets are set to plunge after a 50%-rally. So the earnings of those rallying stocks would better be good as they are running on the sensational multiples reflected in their prices.

These markets need more macrotransition time to consolidate the Covid-shock as the Fed liquidity wave gets more and more subsided. The stock and crypto markets are still experiencing an adrenaline rush from the cocktail of macroeconomic policies, both fiscal and monetary.

Suffice it to say, that the adjustment in the stock and crypto markets is not only highly anticipated, but would also have a healthy impact on a clearer perspective on future price growth. These markets require confidence.

Four steps up, two steps down.

A complex phenomenon occured to the Turkish Lira last Thursday. The Central Bank of Turkey tightened more than expected and lifted the spirits of the currency-buyers. It seemed like a good move at the time.

However, the next day, the governor of the Central Bank was ousted, and despite there not being a paradigm shift in the Central Bank’s policies, the Turkish Lira slightly fell by over 10%.

This crash was triggered by what was called a market confidence shock. I detect the same market confidence misgivings in Jerome Powell’s speeches, where he tries to guarantee that the rates would not go up in the foreseeable future.

Alas, we all know they will.

It seems that Powell has lost the confidence of the market. The Fed is boosting the U.S. growth potential to 6,5% and the inflation projection to 2.4%, but takes no action to modify its policy.

This is very bizarre indeed. While the fixed income market is in a distress call, the stock and crypto markets are still rallying with the pedal to the metal and celebrating the bright post-Covid future according to the Gosplan memo stating that stocks only go up. Hooray!

I publicly endorse Bitcoin. Moreover, I think Bitcoin will exhibit considerable growth in the future. But in order for this to happen, Bitcoin will have to crash.

„Oh, these gloomy Russians“, you must be thinking now. Bitcoin is dealing with the tragic aspects of centralized financial systems.

The decentralized Bitcoin and other cryptocurrencies are going through an adoption period and therefore it is in their nature to represent a great variety of risks and endurance.

But Bitcoin will prevail. As Mikhail Bulgakov once said „manuscripts don’t burn“. Bitcoin was launched more like a manuscript protocol rather than an investment.

By most metrics, the definition of an investment doesn’t apply to Bitcoin. Be that as it may, Bank of America still names it the single best investment of the last decade.

Bitcoin is a non-cash flow producing asset that is only worth what you think someone else is going to pay you in the expected future.

This counts also for gold, objets d’art, or even real estate property with a view of Lake Zurich. These are all high-end scarce goods where prices fully depend on their scarcity and desirability. They all have monetary premiums due to their scarcity.

A careful analysis of obtained data shows that Bitcoin is currently growing as a result of the Fed’s printing and not only because of speculations about its worth at the end of its adoption curve. This market rally is silly in the short term.

The father of value investing, Benjamin Graham, explained this market phenomenon. In the short run, the market is like a voting machine: scoring firms by their popularity. But in the long run, the market is like a weighing machine, assessing the substance of a company.

„Big Short“ investor Michael Burry outlines that Bitcoin is offering more risk than opportunity. The fall will be dramatic and painful. Bitcoin is a massivable bubble and the downfall will be spectacular.

It’s a pyramid scheme where you only make money based on people who enter after you. So people have to keep buying into it in order for it to do well. But investing in crypto as an asset class stays speculative.

Bitcoin is not for the faint of heart. It’s just one big Ponzi scheme, Portnoy said. It is very hard to find Bitcoin’s value or claim that Bitcoin is inherently trading at fair value.

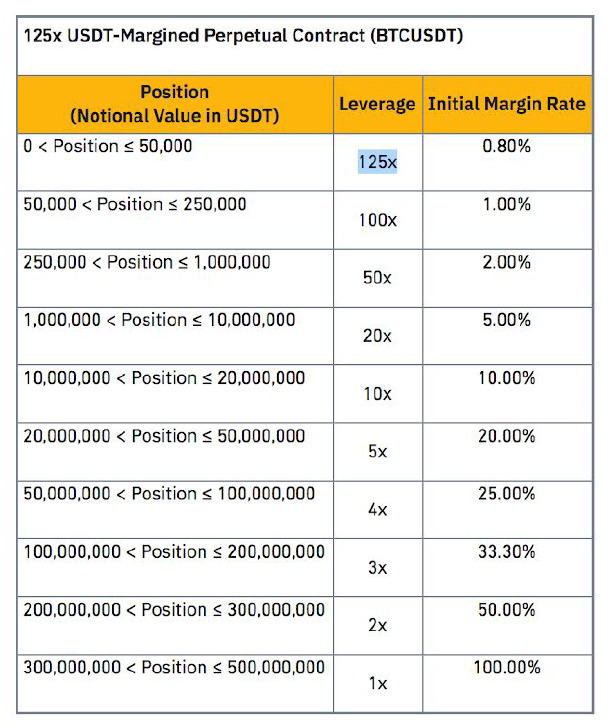

In the meantime, the major cryptocurrency exchange Binance is being probed by the CFTC over concerns that it had allowed to place bets on Bitcoin: the platform is now allowing trade with Bitcoin, Dogecoin or Ethereum with up to 125x leverage.

Yes, you read correctly. Up to 125x leverage on an already highly volatile Bitcoin or insanely volatile Dogecoin. What can go wrong, after all?

Warren Buffett once famously said: You never know who’s swimming naked until the tide goes out.

It’s simple physics, mate. What goes up comes down.

Simple physics. LOL. Had a look at quantum physics lately?

And what do you want to tell us exactly with this article?

There are many strains in this story ranging from Turkey, Us, Fed, Nft etc. mixed together and the point of crypto being speculative and other does not provide much news under the sun.

Also the us printed just about 25% of all $ last year, yet usd getting stronger.

With much love for the russian bear.

The USD and also EUR, GBP are not getting stronger, only the CHF has been weakened by the SNB.

Die Mainstream Meinung eines Bankers.

Unbeleuchtet bleibt das dies im Bezug auf den Wert auch für Geld gilt, mit dem kleinen Unterschied das bei Geld eben nicht nur Angebot und Nachfrage spielt sondern auch staatlicher Zwang.

Die Mainstream Meinung sagt die Kapitalmarktzinsen werden steigen, stimmt, desshalb sind auch alle Short im Tripple Q. Die Märkte gehen aber gerne den Weg des grössten Schmerzes.

Denken wir mal weiter was passiert wenn die Kapitalmarktzinsen auf sagen wir mal 2-3% steigen (was ja historisch nichts ist) die Finanzierungskosten namentlich auch für die USA werden massiv steigen mit dem Strukturellen Defizit wird man dann mal erleben was Exponetialrechnung heisst.

Wenn die Kapitalmarktzinsen im Dollar alleine steigen, zerreisst es alle EMs da die vielfach in Dollar verschuldet sind, ein Grossteil des Weltwachstums kommt aber aus dem EMs.

Gleichzeitig brechen reihenweise Unternehmen zusammen die auf Pump Aktienrückkäufe getätigt haben (wie zB Mc Donalds und zwischenzeitlich ein Negatives Eigenkapital haben) da die Kreditzinsen steigen während die Aktien die auf Höchstkursen gekauft wurden und in den Büchern liegen abgeschrieben werden müssen.

Die Homebank der Amis, das Haus, das laufend höher belastet wird für Cashout, schmilzt ab, die Banken haben riesige Verluste da es zu Zwangsräumungen kommt usw

Never ever werden die Zinsen steigen mathematisch unmöglich.

Und kein Notenbanker möchte in die Geschichte eingehen als die Person die die grösste Depression der Menschheitsgeschichte ausgelöst hat.

Vorallem jetzt nicht, wo man die Alternative Gelddrucken und den Verantwortlichen Corona hat.

Die Notenbanker haben genau die Wahl zwischen:

Der grössten Depression der Menscheitsgeschichte, bei steigenden Zinsen

Die Weltweite Hyperinflation vo Fiatmoney, bei weiter Gelddrucken.

Zweiteres ist bequemer begründbar wo kein einzelner dann der Schuldige ist, und daher für mich wahrscheinlicher…

Zwische drin habe wir sicher noch Intermezzos

Sehr geehrter Herr Hässig

Wäre es nicht vernünftiger, wenn Sie in diesem “Ländli“ mit drei Landessprachen ,

Ihre Seite komplett auf Russisch oder Chinesisch umstellen würden. Sie hätten dann viel mehr Leser und “Clicks“. Dieses “English“, dass den Europäern von den angelsächsischen Siegermächten des zweiten Weltkrieges sozusagen aufgezwungen wird (Gleichschaltung!), ist reine Erpressung. Was wollen Sie damit zeigen oder bezwecken?

Müssen wir jeden Mist der “Amis“ und Engländer billig nachahmen?

Not quite sure what you mean here? CS for example has declared English as its official language in 2003. If you work in a regional bank or maybe in FL I could understand this. But one has to face the music, English has won for the time being, Spanish is close second and in 20-30 years Chinese will be prevalent.

I love our national language and speak them all, but let’s not waste time trying to cover our own incompetece in language skills by trying to push our national languages. There is enough schools in the German speaking part of CH who have banned Hochdeutsch for a start and now French as well.

Sounds like a guy who missed the train and screams it should come back!!

Just too simple minded, man. Think smarter next time.

Anyone out there actually able to connect the dots? Any „Swiss Banker“ who is at least willing to try to analyze the root causes of the many phenomenons mentioned in this article (like the Fed „printing cash“, liquidity, the end of the bond bull market, the stock market rally and possible plunge, pyramid schemes, bitcoin surge, depreciation of the Turkish lira, etc.)? Any „Swiss Banker“ able to go out and talk to people who actually have skin in the game? Or are all „Swiss Bankers“ occupied with polishing their objets d’art in their lake view mansions while letting „Artificial Intelligence“ do their swing trading and selling this as „Momentum Strategy“ to their customers?

Just some food for thought as to some points mentioned in the article:

– The Fed, to a large extent, does not print cash, rather, it creates bank reserves. This in turn would theoretically allow the banks to create more currency through lending, that is, if a reserve requirement would be still in place for US banks.

– The Fed has very limited control over liquidity, because most currency is created by the commercial banking system, and most of it outside the US (Eurodollar). Moreover, there are signs of a liquidity trap, and worse, contrary to conventional wisdom, Quantitative Easing might reduce liquidity and have deflationary effects.

– Rather than being mesmerized by Tesla, Bitcoin, and Gamestop prices, the collapse of the Turkish lira, etc., it might be worth paying attention to what is likely to have a big impact on money markets right now: The unprecedented surge of liquidity created by the partial dissolution of the Treasury General Account as announced in February 2021, and the non-extension of the temporary changes to Supplementary Leverage Rule (SLR), which are set to expire next week.

In jedem Brösmeli steckt es bitzeli Wahrheit bzw. für diese Kernaussage hätte es nicht eines russichen Bloggers in Englisch benötigt:

Sobald die Zahl der Interessenten die Zahl der verfügbaren Wunschanlagen übersteigt und findige Finanzheinis über zusätzliche Anlageprodukte und mittels medialer Unterstützung die Nachfrage weiter anheizen, entsteht ein Hype. Dieser dauert solange bis alle Interessenten Ihre Wunschanlagen getätigt haben und die Ersten aussteigen. Sobald ein Verkaufsüberhang entsteht, geht es wieder runter.

65% of Bitcoin mining (=operating the network) is happening in China.

US – 7%, Russia – 7% (Norilsk, Bratsk and such).

I do not know about „distributed“.

I ment „decentralized“.

😆

It s going to be messy, like a racing asteroid hitting the ocean surface. The following financial tsunami will set in and clean up the piles of fantasy money , created out of the blue on hard discs. Whining and whispering the next day „hell, I didn t know“ will not excuse anything. It will end in tears.

Fantasy money, exactly!

Dieser Artikel hat interessante Ansätze, ist letztlich aber total chaotisch und ohne roten Faden. Was will der Autor sagen? Dass er selbst Chaos im Kopf hat?

Ich habe auch Mühe mit Englisch. *Seufz*

Me no understand. Y U confuse Karl?

Einer der besten Analysen auf IP.Trocken,sachlich und mit viel gesammelten Erfahrung präsentiert. Genau das Gegenteil davon, was uns der SNB Lehrling über die gute Inflation auftischen versuchte.

As long as BTC is used as the new laundrymat of the World, everything will be ok.

Der größte globale Bitcoin Handelsplatz ist Nigeria, wer hat noch Fragen und wer hätte das gedacht? Bitcoin Mining verbraucht mehr Energie als die Niederlande, wer hätte das gedacht? Laut FT von gestern hat Bitcoin Mining auch einen wesentlichen Einfluss auf die augenblicklichen Engpässe auf dem Chipmarkt, da Mining bei der augenblicklichen Bewertung der Bitcoins für den Mineur hoch profitabel ist, wer hätte das gedacht?

Noch einen Ratschlag für den Autor des Artikels: Sortieren Sie Ihre Gedanken und versuchen Sie zumindest mir klar zu machen, was Sie sagen wollen, selten so spekuliert und selten so gelacht!