Documents from a Bahamas lawsuit show that UBS refused to send clients SEC-required confirmations of trades made into the U.S. market.

The clients believe the trades were not executed, that UBS created internal trading records and stole their money.

Could this have occurred to other clients? Top UBS officials refuse to comment on any of the claims or evidence this reporter sent them, or to discuss the matter at all, saying only, „We believe these allegations have no merit.“

Yuri and Irina Starostenko, Italian citizens living in the Bahamas, allege that UBS Bahamas defrauded them by promising to execute trades on their behalf in U.S. markets and taking their money but never actually making the trades.

– UBS is the largest private bank in the world. In 2012, UBS Bahamas offered them a loan deal.

– From June-September 2013, the couple placed 252 trade orders into U.S. markets, but UBS failed to provide confirmations required by the U.S. Securities and Exchange Commission (SEC) that the trades were executed.

– In 2018-2019, after litigation, UBS provided internal documents purporting to show the trades, but they did not include required confirmations from U.S. brokers proving the trades occurred.

– An affidavit from a UBS official in 2019 admitted it had no other trade records.

– The couple alleges over $200,000 in losses from what they term fake trades.

– UBS has won 10 years of delays in the Bahamas case to avoid a judgment on the merits. The dispute continues in the Bahamas courts where judges‘ delays were condemned by a chief justice. In the latest, June 19th, the judge cancelled a hearing that should have granted the Starostenkos a trial date.

– The Starostenkos also sued UBS in U.S. court for securities fraud. UBS got the suit in the U.S. dismissed on jurisdictional grounds, but the couple filed an appeal to the U.S. Supreme Court.

– The story raises the question of why UBS would pay millions of dollars over a decade to a well-connected law firm (a partner sits on the stock market regulator board) for a minor case brought by a day-trading couple unless evidence brought to court would show a pattern of executing fake trades globally, harming massive numbers of investors and markets.

– Top UBS officials declined to comment on evidence that backs up these claims.

– Financial regulators and courts in the Bahamas, Switzerland and the U.S. have the authority to investigate whether fictitious trades were made by UBS Bahamas and if they exist elsewhere in the UBS system. So far, none has done anything.

This story begins under the swaying palms of Lyford Cay where there is evidence of an illicit world of fake stock trades and fleeced investors.

It’s an exclusive Bahamian gated community, home to titans like the Mellons and Bacardis, that welcomed Yuri Starostenko and Irina Tsareva, born Russian, now citizens of Italy.

Lured by promises of easy wealth, their American Dream curdled into a decade-long nightmare.

The Starostenkos‘ story begins with a wartime saga. Irina Tsareva’s Jewish mother survived WWII Odessa, her identity hidden by a grandmother’s fictitious marriage. Yuri’s family fled Siberian repression.

The families in the West might be called middle class. Irina says, „My grandpa Valdimir Isaakovicth Litvak taught in the ship engineering department of Odessa National Maritime University and lectured all around the USSR.“

She says her grandfather fought in the Russian army against the Nazis and that her mother survived the German occupation of Odessa, because her grandmother bought fake documents and made a fictitious marriage to a Polish man who claimed her mother was his daughter and hid her for two years in a village house, because the three-year-old had Jewish looks.

Her family name is Tsareva.

Irina Tsareva says, „Yuri’s family were on his mother’s side Jewish merchants from the Urals and on his father’s side Belarusian kulaks (farmers). Both sides of the family went to Siberia escaping famine and repression.”

„The kulaks lost their lands in the 1920s, and his grandfather was sent to prison in Siberia. He wife followed to be near him. His father taught at a coal institute and worked in mines; his mother was a head of a police department of their city.“

After the Soviet empire collapsed, the couple left Russia in the 1990s, drifted west, became citizens of Italy, and found their footing in Belgium, where in the years of stock boom they did well in the Russian securities market.

In 2007, they moved to the Bahamas to raise their five sons, ages one to nine; the next year, a sixth son was born.

Lyford Cay is an enclave whose prominent residents have included Henry Ford II, Aga Khan IV, Prince Rainier III of Monaco, Huntington Hartford II, Babe Paley, the Bacardis, and the Mellons, who have a family estate with 200 feet of white sand beach.

In 1962, when President Kennedy was in Nassau for private meetings with British Prime Minister Harold Macmillan, he stayed at the home of Canadian brewery tycoon E.P. Taylor, and Macmillan was next door.

Lyford Cay, with yachts bobbing in the marina and ice clinking in the clubhouse, felt like paradise.

Built in the late 1950s by Taylor, it has about 450 luxury villas, restaurants, a marina, a golf course and beaches.

The Starostenkos bought a 2-story, 5-bedroom house with a guest cottage, swimming pool and garden for $2.4 million.

They yearned for security, but this was a paradise with serpents.

The couple had no papers to work locally, but they could trade. They became clients of Credit Suisse AG, Nassau Branch in 2008.

Four years later they switched to UBS Bahamas Ltd. lured by the promise of easy profits through trading U.S. stocks.

UBS offered a $1.4 million loan, their home as collateral, half deposited into a trading account. However, behind the sleek wealth management, danger lurked.

UBS, the largest private bank in the world, operates in over 50 other countries, in all major financial centers.

It has a checkered past. In 2008, U.S. Senate investigators reported how it used code names and encrypted computers to help hundreds of rich Americans evade multi-millions on taxes.

Just a year later, UBS agreed to pay $1.56 billion to the U.S. for failing to report about 14’000 foreigners‘ trades of U.S. registered securities and paying the required withholding tax.

Since then, UBS must report all trades in U.S. securities to the IRS. In 2012, the U.S. fined UBS $1.5 billion for manipulating Libor and other benchmark interest rates.

But there may be another illicit and unknown practice committed by at least one division of UBS and maybe more: the fictitious trades scam.

Here’s how that could work.

From 2013 to 2014, Yuri Starostenko feverishly placed over 200 stock orders on U.S. markets.

Under U.S. Securities and Exchange Commission (SEC) rules, records should have contained trade confirmations from U.S. brokers, proof the trades were executed as ordered on NYSE or Nasdaq.

It should have come from UBS Financial Services, which handled the Bahamas orders. Instead, that never happened.

„We never received a single confirmation,“ Irina Tsareva said, „despite endless requests.“

(Irina is the talkative one, speaks at court hearings. Yuri does the legal research and writes the filings for their pro se legal actions. They can’t afford a lawyer.)

(Irina identifies as „Irina Tsareva“ and „Irina Tsareva-Starostenko,“ while the courts use „Irina Starostenko“ and „the Starostenkos.“ I write whatever is appropriate.)

The Starostenkos protested to their broker that they were not getting confirmations.

At an October 2013 meeting, the UBS account manager cryptically claimed lawyers would need to approve providing confirmations, a violation of SEC rules that traders are entitled to them.

Red flags snapped in the tropical breeze. Why the stonewalling over standard documents?

Even more alarming, Kevin Price, the head of UBS‘ Bahamas trading desk, had from 1994-1998 worked in the U.S. for fraudster Bernie Madoff, who built his Ponzi scheme on phantom trades.

Later, in 2013, when Price worked for UBS Bahamas and handled the Starostenkos‘ trades, he also worked for UBS Financial Services, which was supposed to send the confirmations.

On October 2, 2013, UBS provided a list of 204 trades, dated Sept 19, 2013 for the trades executed on June-September 2013, which it called trade confirmations but included no confirmations from U.S. brokers.

UBS held a trump card, the loan in which UBS lent them $1.4 million in exchange for collateral of their home, worth $2.8 million in 2012 according to the appraisers engaged by UBS.

But the card was a Joker. UBS, which was an offshore bank allowed to provide services for foreigners, had obtained a license from the Central Bank to give mortgages to foreigners for second homes.

However, the loan for trading was made to the Starostenkos eight months earlier, and they were permanent residents.

The mortgage deal was not allowed by the bank’s license. The UBS deal was a fake.

In November (2013), following their protests, UBS sent them a letter demanding they pay back the whole loan four years before the expiration and refusing to refund anything for proved late executions, meaning trades that were done to their detriment after prices changed.

That responded to another complaint the Starostenkos had made.

Faking stock prices is not a new scam. Financier Michael Milken pleaded guilty in 1990 to charges that includes cheating clients by reporting false prices for securities they had sold.

UBS Bahamas is owned by UBS AG Zurich, which has more than 200 companies in the U.S., including UBS Financial Services which handles trading and private wealth management and UBS Securities which is the investment banking division.

By 2014, the Starostenkos were convinced they were being scammed. They contacted UBS’s Zurich headquarters, pleading with the assistant of CEO Sergio Ermotti for help.

Irina told of the lack of confirmations for the months of trading. Headquarters repeated the company response – UBS acted properly.

Sasha Savic, UBS chief of staff for Latin America & Caribbean replied, „We have investigated this matter, and are satisfied that the Bank and its personnel have acted properly in relation to your matter and we cannot find any basis for your position.“

In April 2023, Ermotti, who had left the company, would be brought back to head UBS in the merger with Credit Suisse.

On January 30, 2014, Irina Tsareva again requested confirmations and explained to Fabio Jenny, manager at UBS Bahamas and second after the CEO, that the records provided were not confirmations, but UBS accounting slips.

Jenny said „thank you for the reminder. We will be in touch with you shortly“.

The meeting was scheduled for March 12, but on February 28, Yuri Starostenko received a letter from UBS‘ lawyers Lennox Paton demanding the immediate repayment of the entire loan.

Not a word about the refund or confirmations. Lennox Paton is well-connected. It was the registered agent in the Bahamas for Bernie Madoff.

Brian Sims, the principal partner, was chosen by the Securities Commission of the Bahamas to be liquidator of FTX, the company of convicted fraudster Sam Bankman-Fried.

Another partner, Michael Paton, sits on the board of the Commission, with authority over UBS’s compliance with trading rules.

UBS held all the cards in a stacked deck –well-connected lawyers, obedient regulators, massive resources.

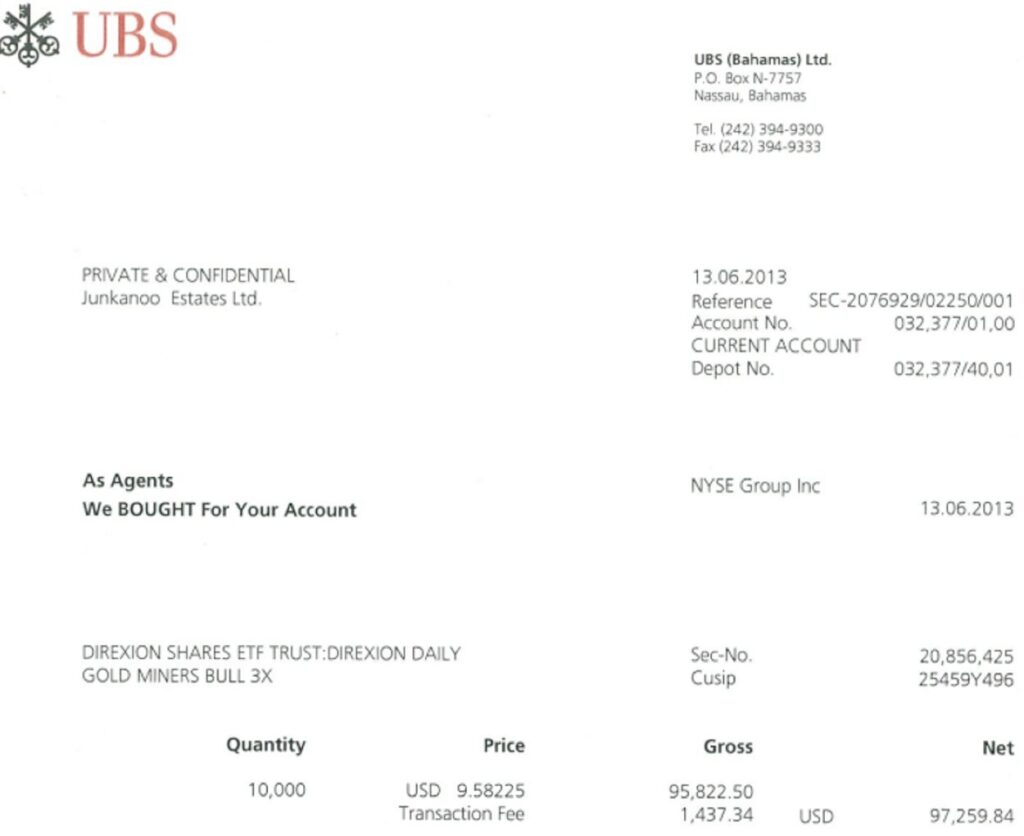

Meanwhile, on February 28, 2014 the Starostenkos also received from UBS 205 sheets delivered for trades from June 13, 2013 to September 18, 2013. It included 199 trade advises.

Again, an internal document, all like this first page, not from a U.S. broker that did the trade.

In 2012, UBS Wealth Management Division CEO Jürg Zeltner told „The Bahamas Investor“ that the Bahamas was an attractive, international financial and booking center, „especially in terms of wealth structuring– in particular the trust business.“

He said „the beauty“ was that it is offshore but close by. He said UBS’s strategy for the Bahamas was „to grow.“ And to be „globally compliant,“ meaning „transparent.“

He added, „The world has agreed to a new, level playing field which The Bahamas is part of. That makes it stronger, because it complies and, if it had not, then I think there would not be too much of a future.“

Less than two years later, UBS liquidated its Bahamas operation.

On March 7, UBS told the Securities Commission of the Bahamas that it was „winding down the banking side of its operations over the next year.“

That included trading. In fact, it was going into voluntary liquidation.

No reason was given, but it avoided dealing with new rules that would have revealed that its traders were not registered (only the CEO and compliance officer were registered), and it removed out of the country officials who could have been readily called to testify in the Starostenkos‘ suit.

Curiously, the minutes of a meeting of March 18, disclosed by UBS during the lawsuit discovery process, says „client follow-up trade confirmations requested some weeks ago“ and at the bottom „trade confirmation to client – legal to sign off.“

But it was not just „legal,“ which UBS Bahamas officials should have known, the denial was illegal under U.S. law for trades on American exchanges.

In October 2014, UBS Bahamas sued the couple for falling below $700K minimum to be kept on its trading account.

It repeated the demand they forfeit the home they had bought for $2.4 million and which assessments showed had increased in value to near $4 million.

Then, on Feb 27, 2018, a team sent by UBS lawyers, with no judicial order, illegally forced the Starostenkos out of their home. Here’s the video.

Local authorities took no action against UBS. The family depended on friends to house them. They would become eligible for food vouchers.

The Starostenkos were struggling to get a trial on the 2014 case. The judges granted numerous UBS petitions for delay.

Then, finally in 2018, Supreme Court Chief Justice Ian Winder delivered a ruling that a trial would take place the next year.

That the discovery, the stage when the parties can claim access to other’s documents and proofs, should be concluded by August 2018.

That expert witnesses‘ statements would be filed April and May 2019 and a trial would take place Sept 23, 2019.

November 1, 2018 they received an email from the Securities Commission of the Bahamas confirming that only two executives but none of the persons executing their trades was licensed.

For a hearing November 12, 2018, the Starostenkos asked that UBS produce trade confirmations.

Instead, UBS arrived with a surprise application for sale of the Starostenkos‘ home „to cover costs“ for $1 million, claimed in an affidavit by a partner of the UBS liquidator, a realtor, while the house had been appraised at $3,684,000.00 in December 2017.

The bank, instead of producing proof of trades, on November 7, 2018 provided a second set of documents, dated December 31, 2013 which were individual pages that showed 51 trades with „Securities Trial Contracts“ from UBS Wealth Management indicating a trade handled by UBS Bahamas (dated June 11, 2013) and related „Contract Notes“ from UBS AG Zurich (dated June 13, 2013) about the same trade.

Since none is a member of the New York Stock Exchange which held the shares, UBS Bahamas would have had to use a member broker, but the documents don’t indicate any.

The UBS members of NYSE are, from the exchange’s website.

Dr. Susanne Trimbath, who worked for the Depository Trust and Clearing Corporation (DTCC), the U.S. national clearing agency, and is a consultant on stock settlement and author of several books on the stock market, explained:

„Every broker/firm has its own system to produce these customer documents. As a rule, what they send to/from the SROs [self-regulating organizations] is consistently formatted (SROs dictate the file layouts).“

Looking at the document, she said, „UBS AG Zurich is the custodian; they don’t appear to reveal the broker-dealer unless those first 3 symbols (can’t read) before ‚UBS AG Zurich‘ is the broker. The column header indicates ‚Broker / Custodian‘ for that line.

She said, „The document header is ‚UBS Wealth Management. The document indicates that the shares were 1) held by UBS AG Zurich as custodian [probably after receiving them from the broker since the $28.75 commission shows there] then 2) moved to Junkanoo Estates Lt. [the Starostenkos‘ company].”

“The second section is the same as the first with the exception of the addition of the $1,437.34 UBS commission. The final message confirms that $28.75 was the broker’s fee (the UBS fee would be an advisory fee).“

„So, to me it says the trade was done on NYSE but by ‚another broker-dealer.‘ If UBS Wealth Management trades as principle, it doesn’t go to an exchange but takes shares from their own inventory.”

She concluded, „None of the documents say that UBS Financial Services executed the trades on NYSE. Even the internal documents only show UBS AG was the agent, not the broker.“

To reprise, here are the claimed „confirmation“ documents UBS provided:

1 On October 2, 2013, UBS provided a list of 204 trades, dated Sept 19, 2013 for the trades executed on June-September 2013, which it called trade confirmations. (3 pages) No mention of brokers.

2 On February 28, 2014 the Starostenkos received 205 sheets delivered by George Maillis for trades from June 13, 2013 to September 18, 2013. It included 199 trade advises. (205 pages) No mention of brokers outside the Bahamas.

3 On October 2, 2018, they received a document dated August 30, 2018, items 81-101 a list of internal trade confirmations, not confirmation documents. No mention of brokers outside the Bahamas.

4 On November 7, 2018, they got a UBS account statement with 51 „Contract Notes“ and related 51 „Securities Trade Contracts,“ documents the bank created. (121 pages)

It mentioned UBS Bahamas, UBS Wealth Management and UBS AG Zurich. No broker in the U.S. Irina Tsareva said: „Why out of 204 are there only 51 Contract Notes-Trial Contracts? And most of them are buys. Where are the sells and the rest of the trades? See this.

5 On December 13, 2018, they got a UBS December 31, 2013 Account Statement for December 31, 2013, containing listings of 205 cash transactions and 202 security transactions. It shows two dates for each trade, alleging that the second date is the date of settlement. (23 pages) No mention of any brokers. See this.

At a hearing February 21, 2019, UBS tried to persuade the judge that trading advises are regular documents for trading in NYSE.

Following the Starostenkos‘ insistence that the papers UBS had provided were not confirmations and after UBS‘ attorneys said that they produced all in their client’s possession and had no other documents, Judge Ian R. Winder said „I will make the order that your client produce an affidavit in the very terms that you’re representing to me now.“

He ordered UBS to swear an affidavit that it did not have other documents.

Then the Starostenkos got a smoking gun. After years of legal wrangles, in a court affidavit, a UBS executive confirmed that after extensive searches, no trade confirmations from U.S. brokers could be located.

The March 7, 2019, affidavit filed by Renate Raeber, former head of business management of UBS Bahamas, said:

„As it relates to Schedule 1 of Exhibit RR-5, to the best of my knowledge, information and belief, UBS has produced all of the contract notes, trade advices and trade receipts in its possession. UBS does not have any other contract notes in its possession, other than what has already been produced.“

Raeber confirmed there were no trade confirmations from U.S. brokers, no evidence that even one of the 204 orders ever reached the NYSE or Nasdaq. (Affidavit is 90 pages, takes a long time to load.)

Irina Tsareva felt vindicated. She said, „This proves our worst fears. UBS likely never executed a single trade on NYSE or Nasdaq.“

The scam would have worked like this: Clients place orders, expecting execution on U.S. exchanges. But the bank never actually routes the trades, while claiming otherwise.

With no real-time confirmation, UBS can retroactively cherry pick execution prices most detrimental to clients‘ accounts.

The bank chooses claimed profits and losses. Compare it to playing poker when only the dealer sees the cards. The house never loses.

The victims are none the wiser, until they demand those obscure confirmations.

For the Starostenkos, the price of peeking behind the curtain was ruinous: the demand for full loan repayment years‘ early and seizure of their home.

They asked for the documents related to her affidavit.

In spite of the evidence that the trades had not been made, on April 11 (2014), UBS appropriated from the Starostenkos‘ account the balance of more than half a million dollars ($525,323.49).

The Starostenkos say that absent proof of the the trades, $204,425.51 should be refunded with the interest.

The judge on the case, Ian Winder, had ordered that each party must file two witnesses and two experts.

Demanding more delay, Raeber, in an August 1, 2019 affidavit, swore that the UBS had no witnesses and that the Starostenkos had not filed expert witness statements.

This last was not true. The Starostenkos had filed four in April and May. Irina Tsareva wondered, „How are you, UBS, with all your employees and sources, coming up on the verge of trial with such an absence of witnesses, while you knew about all those claims since September 2015 and you knew that you must produce witnesses in April – May 2019, which the Starostenkos did, and you didn’t.“

Raeber said that UBS needed six weeks to get its own witnesses. Nevertheless, when, more than six weeks later, the Starostenkos arrived for the first day of the trial September 23, 2019, they heard that it was just a „housekeeping hearing.“

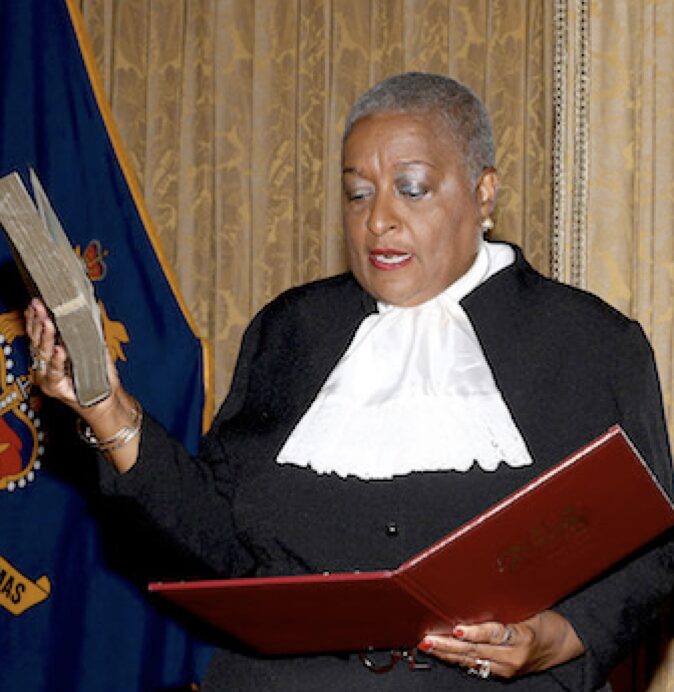

Judge Ruth Bowe-Darville, a new judge on the case, had been sworn in May 2019 just three days before she reached retirement age.

There was widespread criticism of that appointment, questioning the independence of the Judicial and Legal Services Commission.

Yet, the prime minister would extend her tenure for more than two years, enough to keep her on the UBS case.

Irina Tsareva said, „We came to the September 2019 trial, and it was cancelled.“

Judge Bowe-Darville had accepted UBS‘ motion that it had no witness and needed to postpone the trial. She set no future date.

Raising the corruption issue, a Bahamas critic wrote, „Legal observers have opined that she (Bowe-Darville) was one of the most political judges on the bench as the FNM appointed party supporters in an attempt to secure convictions in the prosecution of political opponents.“

She never released a ruling, an order or even transcripts in the Starostenkos‘ case.

Corruption or not, UBS benefitted from Bahamas judges‘ failure over years to hold a trial.

The bank had an interest in destroying the Starostenkos‘ ability to bring the case to court. Its failure to provide proof of trades could lead to questions about the judgment and integrity of UBS CEO Ermotti, who ran the international bank and was informed of these events when they occurred, but took no action.

As CEO of the merged UBS-Credit Suisse, he leads one of the biggest financial institutions in the world.

For four years, Bowe-Darville and her successor allowed the bank’s motions to block a trial and squeeze the Starostenkos, who by then had no income or savings.

Irina wondered „why have all of UBS‘ applications been heard even if they are clearly absurd, and ours are pending for literally years?“

Meanwhile, the years of repeated filings-to-delay, led Chief Justice Winder in May 2023 to rule that „there is no doubt that there was inexcusable delay in the matter (…) on the brink of a trial date.“

He said „The delay caused thereby has deprived the Plaintiffs of a trial date.“

Since March 2023, it was required to fix a trial date six weeks after the defense was filed. Irina Tsareva said, „After such a ruling the course of action would have to go straight towards the judgment against UBS.“

But the new case judge Carla Card-Stubbs, in office just three months (since February 2023), didn’t order a trial.

Instead, in July, she said that UBS‘ application to sell the Starostenkos‘ house would be heard on December 8 and that the Starostenkos‘ application to take back the home and to enjoin UBS from further applications for sale would be heard on December 11.

The order of the hearings appeared backwards. Meanwhile, in September, UBS filed an affidavit by George Damianos, owner of Sotheby’s Bahamas, appraising the Starostenkos‘ home at $1 million.

He was not a certified appraiser in the Bahamas, not listed in either of the appraiser databases. (This or this) Evaluations of $3.4 and $3.7 million had been made by legitimate appraisers.

Then on December 11 2023, Carla-Stubbs ordered that their applications opposing the sale of their home would not be heard until April 22 and 29, 2024.

Not till June 24, 2024 would the Starostenkos be given a date for a hearing on their other applications.

The dates were backwards. And the Starostenkos, after ten years, were still denied the right to a trial, violating the court rules. It was more evidence for the Starostenkos that the fix was in.

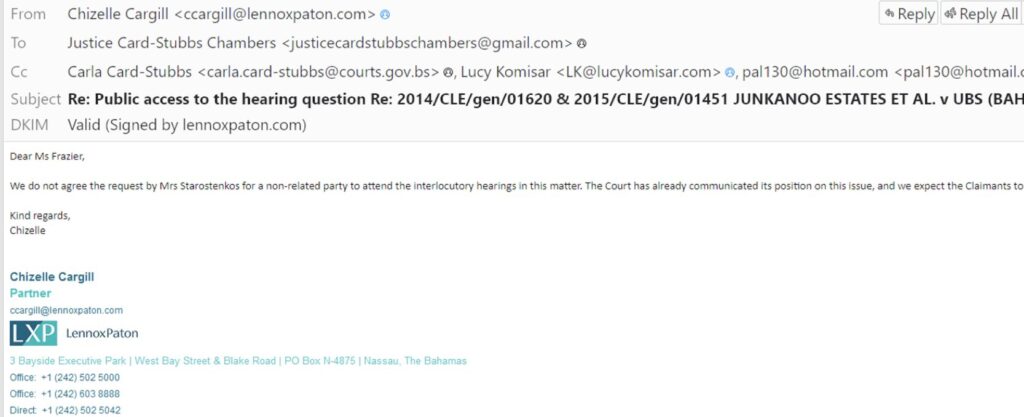

I viewed the February 20, 2024 court hearing on a zoom call. I had watched several other hearings until, apparently on a question from the UBS lawyers, I was identified as a journalist.

During the July 14, 2023 hearing, Judge Card-Stubbs had ordered me off the zoomcast and said I could not attend the December 8 and 11 hearings, because they were on „preliminary“ issues, but I could attend the „main“ hearing, which would be the trial, something judges‘ rulings supporting UBS motions have for a decade successfully prevented.

I tried again in February, but was ordered off.

The Starostenkos protested Card-Stubbs‘ refusal to set a trial date, her order throwing this reporter out of the zoom public court room, and her failure to order a hearing on evidence of the possibly fraudulent appraisal of the Starostenkos‘ home.

The judge refused permission to present the issues to the Court of Appeal. She seemed less interested in a trial on the evidence of UBS’s fictitious trades than the disposition of the Starostenkos‘ property.

She did not recuse herself over consideration of UBS‘ attempts to sell the Lyford Cay house or reveal in the hearings that she is a real estate agent.

The judge ran a hearing April 22 on the Starostenkos‘ attempt to repossess their home and block UBS‘ attempt sell it on grounds the eviction was illegal.

This time this reporter didn’t get on the zoom connection long enough to be knocked off. Here I was (top right) ready to view the hearing. Then the zoom meeting curiously was ended before it began.

When I attempted log in again, I was not admitted. „We’ve let them know you’re here“ remained on the screen for nearly three hours, indicating that the judge did not want an American reporter looking into the case.

The Starostenkos expressed their „concern“ to the court about the ban, noting that Justice Brian Moree – later chief justice — in a 2002 judgment declared:

„The Courts at every level are fully free open and public forums which operate with open doors through which the media (including the International News Media) and representatives of public, civic and non-governmental organizations may enter without hindrance. The proceedings of our Courts may be freely and fully reported.“

The Starostenkos said, „We hope the other side would also agree to Ms. Komisar attending the hearing.“

But UBS said it does not want this journalist at the hearings.

I was blocked again the following week as Judge Card-Stubbs violated the Bahamas courts‘ commitment to allow the public and press at hearings.

If the right to a legal challenge against a global financial company is problematic in the Bahamas, there are the U.S. courts.

The Starostenkos in November 2019 had filed a case in U.S. Federal Court, Southern District of New York, which has authority over violations of SEC regulations.

Curiously, UBS’s legal response was that, „UBS Bahamas allegedly never actually routed trades to New York (or the United States),“ and thus the court had no jurisdiction.

That would confirm the Starostenkos‘ charges and be in violation of SEC rules.

However, the U.S. federal judge Katherine Polk Failla and the appeals court dismissed the case without allowing discovery on grounds jurisdiction belonged in the Bahamas, not the U.S.

(Failla’s former law firm, Morgan Lewis & Bockius, in 2014 bought Bingham McCutchen, one of the main law firms of UBS in the U.S.)

The Starostenkos filed a complaint with the SEC. And in February this year, the couple filed a petition for review by the U.S. Supreme Court.

If UBS‘ own court defense validates the central contention that trades never reached the U.S., how does a bank accused of counterfeiting trades simply shrug off the allegations?

And why should the SEC and U.S. courts not care? The SEC hasn’t responded to the Starostenkos‘ complaint.

The Starostenkos argue the fake trades point to systemic failures at UBS. But proving it has proved nearly impossible, ring-fenced by lawyers and cocooned by foreign jurisdictions.

As for Yuri and Irina Starostenko, this game of pretend trades has devastated their lives and frozen their family in a strange purgatory, scammed by the bank that promised them security, abandoned by the country that invited them in.

A draft of this article was sent to Naureen Hassan, President Americas, UBS, and to Erica Chase, head of media relations, Americas, UBS.

Hassan had been first vice president and chief operating officer of the Federal Reserve Bank of New York and was an alternate voting member of the Federal Open Market Committee, powerful positions in the U.S. financial system.

She declined to comment.

Instead, I was contacted by Jonathan Humphreys, media relations director, UBS Global Wealth Management Americas.

He insisted that our phone conversations and emails be off the record, but that didn’t matter since he didn’t say anything of relevance.

He declined to provide a sample UBS confirmation to prove that the ones the Starostenkos got were valid.

The only quotable response, attributed to „a UBS spokesman,“ was: „We have provided all relevant documentation as required in this (Bahamas court) case. We believe these allegations have no merit.“

In fact, UBS in the court case did not refute any of the evidence that alleges fictitious trades. On the contrary, the UBS Renate Raeber affidavit filed in the case backs up the claim of fictitious trades.

I emailed Humphreys, „If the allegations have no merit …. Tell me what has no merit. Tell me your defenses against them. I would be glad to include that in the story. In fact, I would love to include such defenses in my story.”

“The time to say something has no merit is when you have been given the opportunity to challenge the full text provided to you of everything I plan to write, and you decline to do it.”

There was no response.

In a shuffle announced in July that named a new UBS Americas chief, Hassan said she would leave the firm.

Though UBS Bahamas continues in voluntary liquidation, UBS AG, the Zurich conglomerate which owns the Bahamas subsidiary, on January 22, 2024 registered in the Bahamas with full banking services.

The Starostenkos added it as a defendant in their case. But UBS refused to be served with the legal papers at the Credit Suisse office in the Bahamas.

UBS AG did not respond to my query asking why. The Starostenkos in March asked for a court judgment on UBS’s failure to acknowledge service.

No response from Carla-Stubbs. On June 19th she cancelled a hearing at which she should have set a trial date.

A May 8th hearing before the Court of Appeal, which included the Starostenkos‘ request for a ruling affirming that court hearings are open to the public and journalists, was opened and closed in 10 minutes, postponed to June 20th.

They were trying to get the Court of Appeal to order Judge Card-Stubbs to follow the law and set a trial date. On June 19th she cancelled the hearing at which she should have set a trial date. The Appeal court hearing was also cancelled.

Then on June 11th, Bahamas Attorney General Ryan Pinder filed an application with the Supreme Court asking for a ruling that the Starostenkos not be allowed to file any legal proceedings without a judge’s approval.

(Pinder, with a Bahamian father and American mother, got an MBA and law degree from the University of Miami, then took a six-month course in the Bahamas so he could practice there. He renounced his U.S. citizenship to run for parliament.)

The application is based on an affidavit by Lena Bonaby, an associate of Delaney Partners and a member of the law firm’s team handling the voluntary liquidation of UBS Bahamas.

The affidavit said their legal proceedings were „vexatious.“ In other words, a UBS lawyer says the Starostenkos‘ attempts to get a trial on the merits is „vexatious.“

Now, at the end of a decade when judges have repeatedly refused to order a trial, the attorney general, a political appointee attempting to block the Starostenkos from using the court system at all, confirms the end of equal justice in the Bahamas for anyone challenging a commanding institution such as UBS.

At issue for the Bahamas is how to reform its dysfunctional, on the face of it possibly corrupt, stock regulating and judicial systems.

At issue for Swiss financial regulators is whether fictitious trades existed at UBS Bahamas and if they exist elsewhere in the UBS system.

At issue for the SEC and American courts is whether they should allow to facilitate possible fraud on U.S. stock markets and if the SEC should investigate whether fake trades to U.S. markets exist elsewhere in the UBS system.

Lucy Komisar is an investigative journalist who writes about financial and corporate corruption. She won American Gerald Loeb, National Press Club and other awards for exposing how the Florida Banking Department enabled Allen Stanford’s $6 billion Ponzi scheme. Her articles have appeared in the New York Times, Washington Post, Wall Street Journal and other major U.S. publications. Her website is TheKomisarScoop. Her twitter/X handle is @lucykomisar.

Shady bank, shady clients, shady trades? Die UBS ist für die Schweiz ein Risiko. Sollten die Märkte je unter heftigen Druck geraten, wird es zehntausende Kunden mit individuellen Geschichten geben, die Ihr Geld zurückhaben wollen. Alle klagen erfolgreich in den USA, und die Schweiz bezahlt die Rechnung. Verkleinert endlich die UBS, das Wealth Management Geschäft ist nicht risikolos, wie so oft als Geschäftsmodell hervorgehoben.

Russen nach Hause schicken und gut ist. Ist doch logisch 🤷🏻♂️

Zur Bank geht man arbeiten wenn man sich für Strassenkriminalität zu schade ist.

WTF?! Die Autorin übertreibt masslos, zieht die Geschichte bis zu Jesus und Maria, Stalin und den Juden… Der Fall ist klar: Die Russen mit vermutlich gekauften italienischen Pässen versuchen ihr Glück mit den Schweizern.

Warum erst jetzt, 11 Jahre später, festgestellt wird, dass sie keine SEC-Bestätigung haben – entweder haben sie ihr ganzes Geld mit Day Trading verloren (bad UBS, bad!), oder die SEC-Amerikaner haben ihnen auf den Schlips getreten, und jetzt müssen die armen Russen mit italienischen Pässen auf den Bahamas sich gegen die Auslieferung verteidigen. Ein furchtbarer Artikel, ein Wortdurchfall und ein Durcheinander von „sie sagte“, „er sagte“.

Vielleicht weiss Wagensklavin Rad.

Mal das ganze Vermogen abgeben, da sonst der Böse ganz Böse wird.

Dann eine finsnzielle Pufferzone einrichten – you know.

Sehr lang, nicht sonderlich interessant. Speziell, dass die Anleger als Grund für die Auswanderung von Italien auf die Bahamas erklären, man wolle die Kinder dort aufwachsen sehen.

Nun ja, die Hindernisse wie Tiefbesteuerung hat diesen ehrlichen Russen nichts ausgemacht.

Vladimir hilft auch Dir.

UBS. Klingt fundiert könnte aber doch eine weitere US Attacke auf eine Schweizer Bank sein. Es ist verdächtig, wenn die ganze alte Geschichte der UBS aufgewärmt wird, längst vergangene Vorfälle. Nichts gegen unsere Freunde die USA. Aber auf die Macht der Schweizer Banken haben sie es längst abgesehen.

„You know, news is when you print something someone else doesn’t want you to print.

Everything else’s public relations.“

My phone ran out of memory trying to scroll to the end of this rant. Great to see random brain farts in English on this ad page.

And who was the „brain“ executing this alleged scam at UBS Bahamas?

There must be some names, persons, relationship managers at UBS Bahamas doing this? Who took the buy/sale orders from these clients? how (telephone/online/written)?

Where did the money go at the end of the story? Evaporated? Covering somebody else‘s losses? Embezzled?

What about the accounting books of UBS Bahamas?

Great jurisdiction to do business, the Bahamas, by the way. Perfect judicial system based on Morgan & the buccaneers.

Good questions, Thank you Isabel!

We asked the same in 2018. But as you can see from Lucy Komisar’s report, in March 2019 following the judge’s order, UBS swore an affidavit saying that they had nothing. And that’s it; nothing has changed until now.

Yes, it is sad that the system in the Bahamas is so weak. It’s supposed to be the Switzerland of the Caribbean, and the people here are generally very good.

Interesting article. Just for an investigative journalist, you terribly fail at clarifying the source of funds of Irina Tsareva and Yuri Starostenko. You mention all but one sentence: „in the years of stock boom they did well in the Russian securities market“…like, really? I would be interested in how this Russian couple managed to earn millions and live in the Bahamas.

What is your real name, please?

I am Irina Tsareva-Lirtvak born, married Starostenko and have no fear to say it. And you?

Indeed, after 10 years of silence, we are very thankful for the gigantic work Lucy Komisar did, and for her courage and persistence in bringing it to the public attention.

We are also thankful to the editor, Lukas Hässig (lh), who has published it. UBS lawyers in the Bahamas worked hard to silence all local media. I believe even our website has been somewhat obscured. But now the story is open to public opinion https://letsmaketheworldfairer.wordpress.com/2018/03/20/the-medias-refusal-of-our-story/.

So funny. May all the readers of this Blog know who you are? And what are your grounds and legacy to attack in such an unprofessional and vulgar way one of the most courageous and leading journalists in the area of financial crime investigation and drama critics? If our gains have shaken you, it is trading, not all scams, but real trading, learned, mastered, and the new social class which will hopefully bring prosperity in all fields of life. https://letsmaketheworldfairer.wordpress.com/trading/

Js, immer diese armen privilegierten mehrfach Doppelpass-Bürger mit mehreren Immobilien und grossem Vermögen, gemacht in Depressionen ihrer Herkunftsstaaten (hier im Privatisierungs-Zerfall der

UdSSR)… oft Steuerflüchtlinge mit Briefkastenfirmen auf den Bahamas…. Machen 5 Kids mit Privatschulen und traden 300x in knapp einem halben Jahr. Keine Arbeitsbewilligung auf den Bahamas, aber vermutlich wurden die Aufträge auch nicht am Wohnsitz aufgegeben, sondern aus dem Haus im IT, CZ, oder from the house in chique Belgic.

Nun brauchen die arme Opfer Essens Marken und verweisen auf ihre Vorfahren, um von der ruling 0.5% Elite unterstützt zu werden.

Jede Wette, da sind noch mehr Immos im Spiel, die nicht ib keinem Steuerauszug erfasst sind… Wer spekuliert mit Immo Kredit und stellt sich dann als Opfer dar, flüchtet vor Steuerbehörden in Mickeymouse-Staaten und wundert sich dann über korrupte Gerichte und Beamten?!?

„Sorry, but playing stupid games, you may also winn stupid prices“ … Gleiches könnte den USA und der EU blühen, wenn man sich ständig mehr für die Interessen dieser elitären Doppel und Dreifachbürger einsetzt (Tax and Eco.-Fugitives), als für das eigene Volk-

Probleme sollen dort gelöst werden wo man herkommt.

Ihr Zitat:

„Wer spekuliert mit Immo Kredit und stellt sich dann als Opfer dar, flüchtet vor Steuerbehörden in Mickeymouse-Staaten und wundert sich dann über korrupte Gerichte und Beamten?!?“

Ziemlich einseitige Sichtweise. Diese Spielchen funktionieren ja nur deshalb, weil in den „Mickeymous-Staaten“ die Regeln mit Absicht so aufgebaut wurden, damit Geldistitute wie bspw. eine UBS illegale „Finanzierungen“ für sog. Privilegierte eben genau dort durchziehen kann.

Selbstverständlich aus aus Banken-Sicht alles legal, korrekt und richtig – ironie off!

Herr Haessig

Im Ernst?

Lucy Komisar?!

Lucy Komisar und Matilda Moore hahaha

Did anyone read this ’short‘ article up to the end?

I am short on time.

No.

Yes. Und wenn nicht alles verstanden wird. Deepl.

Fleissige UBS Juristen mit guter Vernetzung zur Justiz. Ja, so läuft der Hase. Ist nicht neu. Nur das erste Mal sehr detailliert ersichtlich. Man darf sich die Frage stellen, wer alles vom^n wem gekauft wurde. Ging wohl auch nicht über die NYSE 🤣.

Wow

Immer, wenn man denkt IP habe den Tiefpunkt erreicht, zaubert Lukas etwas aus der Tasche, um das Gegenteil zu beweisen.

Gaht’s no?!

Global präsent. Auf jeder Insel. Mit fast allen Dienstleistungen. So war es immer schon in der Vergangenheit. ‚Wholesale‘ as its best‘.

Betrug, Betrug und wieder Betrug. Swiss Banking vom feinsten halt. Und Ziel unseres Freundes, die USA, ist die Zerstörung der Schweizer Finanzbranche. Zuerst wurde die CS „liquidiert. Nun kommt der nächste Opfer: die UBS. Bis es die doofen USA-loyalen CH-Bünzlis merken wird es zu spät sein. Und nein, unter Trump wird es nicht besser.

So,waren es die Amis die die krummen Dinger gedreht haben oder die Clowns von der CH Bank.Also Du Plapperi nachdenken ist nicht Deine Stärke.

I went to the homepage of this woman Lucy Komisar and scrolled to her latest blog entries. I read a few articles of her relying to aspects which I have some knowledge in. I mean, let us be honest: There are a lot of crappy articles on her website. Sorry. That doesn’t meant that everything she is writing is crap or wrong (so I don’t know if she got the facts right in this IP article here), but the probability is higher when having read allready articles which aren’t entirley based on facts.

The story seems strange…why didn’t those russians with italian papers simply sell their stocks and went to another bank? They had those internal UBS papers as a proof that they gave money to the UBS. I get it, that UBS couldn’t deliver official US dosuments, but why not leaving UBS when you were sure that they are not trustworthy? Perhaps I missed the part in the large (somewhat unstructured) text.

Überrascht jemand das Verhalten der UBS als ‚Botschafterin‘ des Sozialschmarotzer-Paradies namens Helvetia?

Nix Neues im Westen! 🤣

May I politely ask you, what is your real name,Eichlefääger, and how you can prove that you are not a UBS’related troll?

Your accusations towards the repitable, award winning journalis are baseless,false, lacking any factual support and are offesnive to the public’s good, which has recognsied Lucy Komisar in multiple occasions to be one of the leading finacnial crime journalists.

You will be among the first in my list if you do not aqppologies, within 24 hour.

> The story seems strange…why didn’t those russians with italian papers simply sell their stocks and went to another bank?

First of all your definition of our status show how prejudiced you are, sorry for you. I love both of our Motherlands – Russia and Italy and are deepley venerate the new one – the Bahamas.

> why didn’t those russians with italian papers simply sell their stocks and went to another bank

Because your UBS’s friends did not allow us to do so, despite our extremely generous offer sent to them in October 2013. BTW, it was not about selling the stocks, but to settle the refunds UBS owed us due to the wrong execution of our trade orders. Have you heard about trading, Leo Melamed, and Larry Williams?

> russians with italian papers

How funny, are you also suffering from Russophobia, Antisemitism, Islamophobia, or some similar diseases? Then don’t try trading ever; you will burn all your capital

I have to add something to my previous comment:

After some research I found multiple articles about Lucy Komisar and one specific article from „her“. It was about Navalny and it was proven that she „wrote“ this article with KI support and made up sources and made up „facts“.She published her article first in a Russia Today related media outlet called „The Grayzone“.

Wow…I am not impressed but shocked … this is really crashing her credibility for me…

Und wieso muss der Fääger das in krummen englisch kund tun?

Sie passt damit perfekt in die Riege der unsäglichen Gastschreiber auf IP. Lukas hat einmal mehr null Aufwand betrieben, ihm ist es offenbar egal, wer hier was publiziert. Aber Hauptsache Kommentare zurück halten und abändern.

@ Aha

Immerhin kann er Englisch. Du wohl max. noch bruchstückhaft Schulfranz, oder? 😉

De Fääger cha nöd-emal Änglisch. Ohni Grammarli gaht bim Fääger nüt! Mer schmöckt sogar d’Bratwurscht zwüschet de Ziile! 🌭🤣

Was soll dieser Artikel mit Anspruch Investigation, der auf das eigentliche Kern-Problem nicht eingeht? Mit was für Aktien haben die Kläger eigentlich spekuliert? Es scheinen russische Aktien zu sein, was darauf hindeutet, dass sie sich nicht ohne Mittel als ursprüngliche sowjetische Bürger und jetzt Italiener in den Bahamas niederlassen konnten. Wenn sie natürlich dafür ihre dortige Villa der UBS und auch ihre sonstigen Wertschriften verpfändet haben, wird natürlich die Bank sie exekutieren, wenn die Deckung nicht mehr gewährleistet ist. Ihr Anwalt hat nun eine juristische Finte ins Spiel gebracht, indem darauf hingewiesen wird, dass die UBS ihre Börsenaufträge formell nicht gemäss den SEC-Richtlinien abgewickelt hat, aber immerhin sicher gemäss den gesetzlichen Vorschriften der Bahamas. Wenn man nicht auf den Bahamas Gerechtigkeit findet, versucht man es in den USA, vielleicht öffnet sich da irgendwo ein Türchen, worauf die UBS die Kläger bezahlen muss. Sie hoffen natürlich, die Gerichte in den USA können mit Leichtigkeit der Justiz der Bahamas einfach vorschreiben, was sie zu tun haben. Ich bezweifle es.

Der Artikel hat natürlich wunderbarerweise auch seine emotionalen Seiten. Wenn man natürlich sein stattliches Haus in der Nähe von so steinreichen Familien, wie den Mellons und Bacardi verliert, ist dies bitter. Immerhin kann man in den Bahamas eine Strandhütte mieten und vom Fischfang leben. Es gibt dort natürlich zu Recht keine Sozialhilfe für Ausländer und die Sozialhilfe in Italien ist nicht überwältigend, auch nicht für sogenannte Verfolgte des kommunistischen Regimes, die plötzlich ihr Judentum entdecken und die Nazizeit im 2. Weltkrieg.

Wow, der Rolf ist nicht nur wie bei Thiam ein kleiner Rassist, sondern macht auch noch einen auf Antisemit. Tja, Luki, Gelegenheit macht halt…

[…] stock trading clients of global bank UBS. On the right, UBS CEO Sergio Ermotti in Zurich. My story today in Inside Paradeplatz, a daily financial publication run from Zurich by Lukas Hässig (twice […]

Dicke Post. Wobei…die vielen fragwürdigen Trades…und trotzdem bei UBS geblieben???? Wie kamen die wirklich zu ihrem Vermögen und Russen sind sie ja sicher auch noch. Vieles ist unlogisch. Interessanter Artikel. Ich habe ihn nur kurz überflogen, da sehr lang. Note 5.

Verteilt Note 5, schafft es aber nicht einmal den Text ganz zu lesen. Du passt 100% zu/auf IP

@Haha. Haben Sie ein Problem, meinen Text zu verstehen? „Kurz überflogen“ heisst nicht „nicht den Text ganz lesen“, sondern schnell gelesen

Schon lustig – verwendet man den vom Betreiber dieses Blogs im Titel erwähnten Bezeichnungen für die Haarfarbe dieser Dame, dann wird dieser Kommentar nicht publiziert.

Aber ja auf IP kann man aaalllleees schreiben/lesen – nicht so wie bei den bösen Ringiers *lachmichtot

Wenn Sie sich totgelacht haben, hat es hier ein substanzloser Kommentarschreiber weniger. Also nur zu…

Wer liest bloß so ein bs ?

Who cares 🤷🏻♂️

Geh dorthin wo die Probleme herkommen.

So lange der Bahamas State Governor zufrieden ist, geht alles.

Falsch spekuliert und jetzt die UBS für die eigene Dummheit unter fadenscheinigen Argumenten verantwortlich machen… Für ein bisschen Gratiscontent und damit AdClicks ‚publiziert‘ Herr Hässig wirklich auch den hinterletzten bs. Bedenklich!

Bitte Orthographie korrigieren: Caribbean (und nicht Carribean)

Overly long texts make lies not more true.

Was soll dieser überlange Beitrag im IP, das ist doch echt eine Zumutung für jeden Leser.

In my opinion this story seems

to be all phoney.

>they can’t afford a lawyer

Hahahahaha das glauben Sie doch selbst nicht! Leben auf den Bahamas in einer exklusiven Gegend, aber keine Kohle für Anwälte?

Auch: tl;dr

Diesen ganzen Schrott liest jemand???

Sehr lang, das Ganze.

Amüsant bis abstrus: Nach den „Essenscoupons“ war dann für mich endgültig Schluss. Eure Kommentare bestärkten mich darin.

Die Kontrahenten dieses Spektakels verdienen sich wahrlich gegenseitig…

[…] Lucy Komisar, “Scam in the Caribbean,” Inside Paradeplatz, October 8, […]

[…] the only explanation for this arduous effort is that we have discovered and are trying to stop the Fictitious Trading scheme run against the listed securities in the United […]